Key Highlights

Category

Financial Services

Solution highlights

- Workloads: Data Warehouse, Data Engineering and Data Science

- Components: Apache Impala, Apache Spark, Apache Sentry, Cloudera Navigator, Kerberos

- Cloudera Professional Services

Applications supported

- Business intelligence

Impact

- Improved customer experience

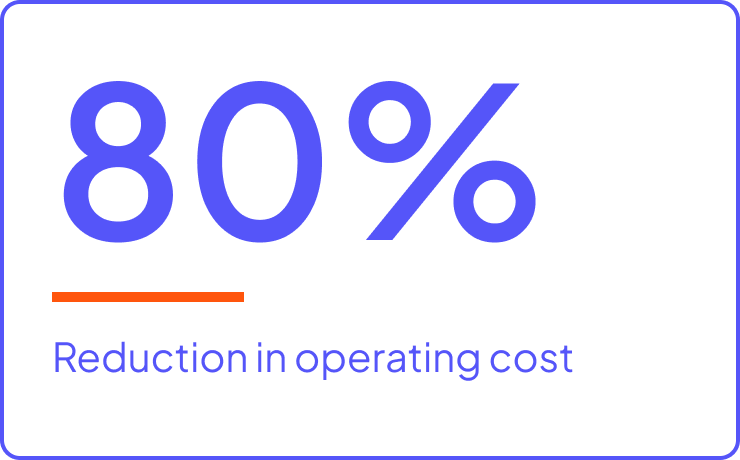

- 80 percent reduction in operating costs through a wide-range of customer service and operational improvements

- Decrease in cost to service customers while increasing revenue through better service

DBS is creating a data-driven organization in which staff can gain insights from billions of events and be on the forefront of innovation.

DBS is one of the leading banks in Asia. The drive to deliver a superior customer experience led DBS to become more data driven and better predict customer needs across channels. However, the company’s traditional technology stack for supporting advanced analytics was expensive to scale and not flexible enough to support this work.

Challenge

The drive to deliver a superior customer experience led DBS to become more data driven and better predict customer needs across channels. However, the company’s traditional technology stack for supporting advanced analytics was expensive to scale and not flexible enough to support this work.

Solution

DBS built a central data team and enterprise data hub that enables staff to experiment more and be on the forefront of innovation when it comes to understanding the customer experience and applying human-centered design to its services.

Results

With the ability to more easily store and analyze billions of events in a modern data platform, DBS can answer questions before they’re asked to more effectively engage customers and deliver better service. “We’ve applied it to a whole range of different use cases and every single one, we see a massive uplift in terms of the base case that we normally do,” said Gledhill.

Additionally, the transformation to a data-driven organization has significantly improved operations across the organization. For example, HR staff can understand and predict why an employee might leave so they can take action early to retain employees. Audit can staff predict which branch might have the next audit issue. Risk management staff can better detect fraudulent transactions. And operational staff can understand and predict customer flows, ATM load, and call center volumes.

The company’s data-driven approach has helped it improve services while reducing costs. “We’ve seen anything in the region of 80% reduction in operating cost in a much shorter build time. The real big benefit lift though is the benefit it provides to the business. If you look at our digitally engaged customers, we see material lift in how much revenue a digital customer brings to the bank,” explained Gledhill.