Key Highlights

Category

Impact

- Lowered expected OpEx by $200,000 a month

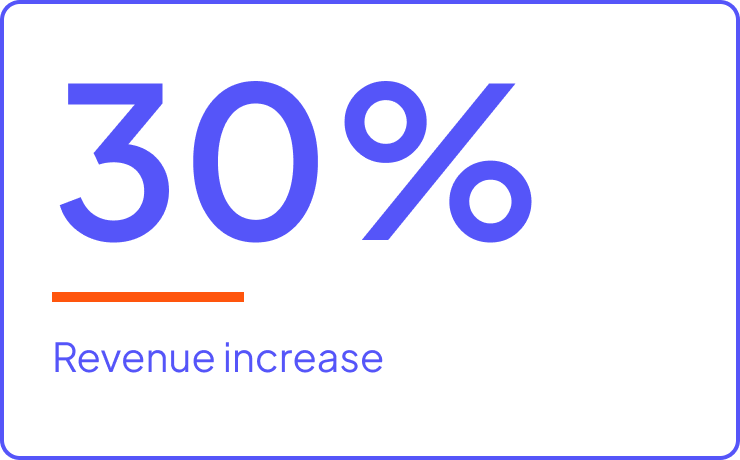

Drove product revenue growth by more than 30% with their entry into new regional markets

- Built in data management compliance with regulations through strict enterprise security and governance control

Each day, this global consumer credit company collects and aggregates data for billions of people and corporate entities. Lenders subsequently request this data as they evaluate customer credit risk. In these daily exchanges, the consumer credit company uses best practices that affirm quality and ensure privacy.

As transactions scaled to tens of billions per month, the consumer credit company re-evaluated their technical underpinnings. With costs prohibiting the extension of existing infrastructure, this consumer credit company searched for a scalable, cost-effective technology that addressed regulatory compliance.

Challenge

As transactions grew, the consumer credit company strained due to the growth of over 200 global data warehouses. They experienced degradation in performance and scalability; in addition, they were physically limited on expanding out their data warehouses. As they balanced these technical hurdles, they faced increased expenses, limited flexibility to build new markets, and expanded data restrictions placed by local governments. They sought to elegantly resolve complex credit underwriting problems in account management, customer acquisitions, and collections using advanced analytical models.

In addition to their expansion woes, the company’s tactics required large data assets to be available to multiple customers. This solution worked well until growth uncovered inelastic challenges evolving into noisy neighbor troubles. Increased tenancy strained the architecture and introduced heightened security provisions. The company faced increased risk, high OpEx costs, and blown budgets.

As their success in business ushered in growing pains, the company knew they needed to transition their architecture. Their business needed to maintain enterprise security and governance for regulators while supporting multi-tenant, isolated environments for their users across all applications. No more noisy neighbors! To keep costs low, they also required auto scalability and agility.

Solution

The company deployed their new architecture using Cloudera on AWS and its Shared Data Experience (SDX). They used Cloudera’s native replication capabilities to migrate their on-premises data to Cloudera on cloud for several tenants (and are continuing to use it to move additional tenants). Their customers will consistently experience good performance through auto-scalability and isolation; more importantly, the company saves money when the system scales back down to zero when not in use. These disruptive improvements in the speed and scale of data operations enables them to manage and analyze data, be more competitive, and run business efficiently.

Beyond speeds and feeds, the company further enables customers to combine and to federate other corporate datasets. This use case allows for more effective profiling and promotions. By collecting data from streaming and batch sources, their data availability increases and downstream accuracy is improved.

Cloudera’s cloud-native elasticity provides on-demand scale for its largest customers and allows low entry costs to attract smaller customers and expand into new regions. This is all done while maintaining strict enterprise data security, governance, and control across both on-premises and public cloud environments.

Results

With this new architecture, the consumer credit company is on track to lower OpEx by nearly $200,000 per month. The company was able to consolidate multiple products and architectures into one standard platform to reduce operational hurdles and required personnel training. This reduction in cost and training removes barriers to entry in new international markets and targets; this results in nearly 30% revenue growth. Cloudera gives the company a common platform to utilize any public cloud for on-premises data centers providing the same type of services.