Key Highlights

Solution highlights

Impact

- ’One Bank Data Architecture’ A centralised data platform to break down data silos and facilitate research

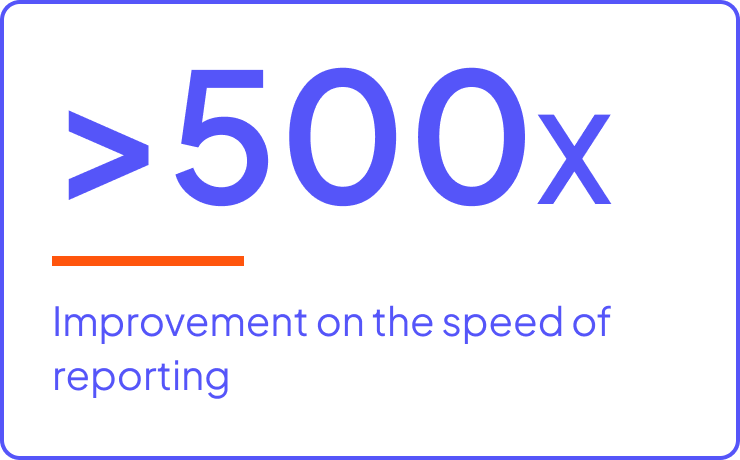

- Speed of reporting has improved by more than 500x, from 2 days to under 5 minutes.

- Data is reliable and compliant

The Bank of England is the central bank of the United Kingdom formed in 1694. The Bank of England’s mission is “to promote the good of UK citizens by maintaining monetary and financial stability”. As well as managing the UK’s currency, supply of money and interest rates, the institute has a diverse range of responsibilities including gathering and analyzing data from banks, building societies, credit unions, insurers and mortgage companies to inform policy decisions and guide UK government departments and international organizations.

Challenge

Using traditional tools to satisfy the demands of analysts and economists was becoming more of challenge. The Bank needed a centralized data platform to break down data silos and facilitate bank-wide research. There was also a need for a system that could collect, store and process larger datasets that could be shared with researchers and the data science community, as well as support operational systems. The EMIR (European Market Infrastructure Regulation) data presented the biggest and most immediate challenge.

Solution

Instead of processing and aggregating smaller slices of EMIR data sequentially and threading back together for final analysis, HDP has enabled analysts to now be able to take their code to the granular dataset in its entirety. The platform has enabled the Bank to successfully and efficiently collect other datasets for research and analysis.

Results

Ultimately, by delivering a key component of the ‘One Mission, One Bank’ Strategic Plan, the Bank of England is starting to leverage the benefits of a central data platform. The Bank of England can continue to fulfill its duty of providing a stable and reliable foundation for the UK economy and broader banking ecosystem. Utilizing HDP, the analysts are able to significantly reduce the time it takes to process a dataset containing over 15 billion (and growing) derivative transactions. Speed of reporting has improved by more than 500x, from 2 days to under 5 minutes.